[Ferro-Alloys.com] Citi Downgrades Outlook: Iron Ore Prices Continue to Bottom Out Under Multiple Pressures

Due to seasonal demand weakening and expectations of production cuts by Chinese steel mills, iron ore prices are approaching their lowest levels since September. The trajectory of iron ore prices is closely tied to the macroeconomic environment. The global economic slowdown has led to a contraction in steel demand, and as the steel industry is the largest end consumer of iron ore, weak demand has directly caused an imbalance in the iron ore market, putting downward pressure on prices.

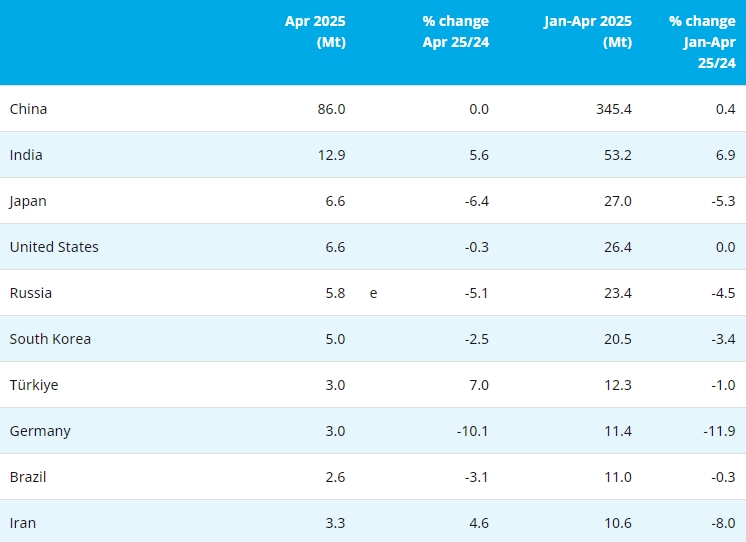

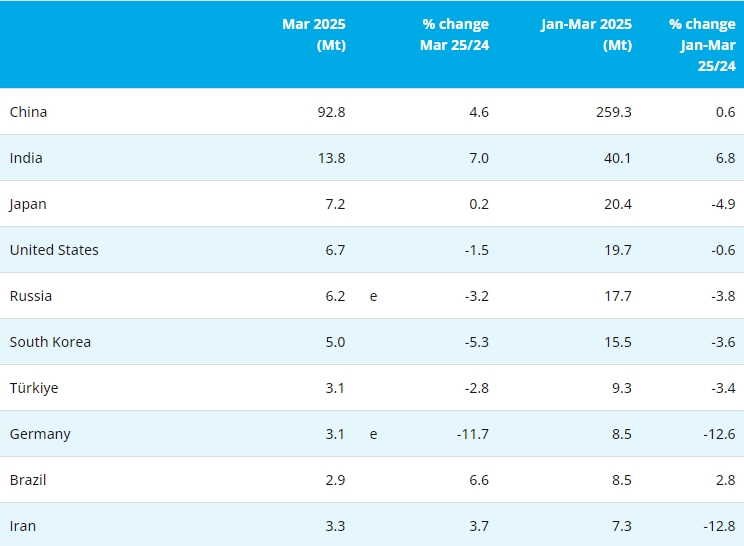

Recent persistent rainfall in southern China and high temperatures in the north have significantly impacted construction progress at building sites. The latest statistics show that China’s daily steel output in May declined compared to April, with a year-on-year drop of 7%, marking the lowest production level for the same period since 2018. Market analysts point out that the arrival of the traditional off-season for construction in summer, coupled with the Chinese government’s steel production reduction policies, has continued to exert downward pressure on iron ore, a key raw material for steel production. Although iron ore futures ended a four-week losing streak (the longest since January this year), overall market sentiment remains weak.

In its latest research report, Citi Group warned, “Due to seasonal factors, China’s steel demand may remain weak in the coming months.” The institution also lowered its iron ore price forecasts, noting that China’s sluggish real estate market shows no signs of improvement, while deteriorating external trade conditions for the manufacturing sector will further suppress demand. Specific adjustments include: reducing the three-month iron ore price forecast from $100 per ton to $90 per ton, and lowering the 6-12 month target price from $90 per ton to $85 per ton.

Iron ore futures on the Singapore Exchange fell for the fourth consecutive trading day, dropping below $93 per ton to a session low of $92.90 per ton, a decline of 1.2%. Meanwhile, declining risk appetite among investors has led to broad weakness in industrial metals. Copper futures on the London Metal Exchange (LME) fell 0.3% to $9,674.50 per ton, while aluminum prices dipped 0.2% to $2,508.50 per ton.

- [Editor:tianyawei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think